In mid-November 2014 the UAE’s low-cost carrier flydubai issued its first Sukuk – a Sharia-compliant financial certificate – raising over USD500 million to support its further growth and refinance current obligations. The five-year-deal received over USD3 billion in orders with 3/5 of investors from the Middle East. While clearly indicating the growing investors’ confidence in the airline industry, the deal has also fuelled the discussion whether separate Sharia-based deals might actually be a rising new trend in the global aviation finance market.

In mid-November 2014 the UAE’s low-cost carrier flydubai issued its first Sukuk – a Sharia-compliant financial certificate – raising over USD500 million to support its further growth and refinance current obligations. The five-year-deal received over USD3 billion in orders with 3/5 of investors from the Middle East. While clearly indicating the growing investors’ confidence in the airline industry, the deal has also fuelled the discussion whether separate Sharia-based deals might actually be a rising new trend in the global aviation finance market.

PIONEERING THE SUKUK

Since Emirates (as an aviation company) pioneered the Islamic capital market back in 2005, many other industry players such as AirAsia, Air Arabia, GE Capital, Royal Jordanian, Ethiopian Airlines, SriLankan Airlines and Pakistan International Airlines have already either conducted or expressed their strong interest in Sharia-compliant solutions to support their development. In summer 2014 the International AirFinance Corporation (IAFC) together with Airbus and Islamic Development Bank launched a USD5 billion Sharia-compliant leasing fund. The initiative supported by a major aircraft manufacturer came as an acknowledgment that Sukuk deals are no longer a rare alternative, specific to a certain region, but rather a new trend in the global aircraft market.

“Outside aviation the Sukuk industry has been actively developing since the early 2000, expanding over 20 times and topping USD120-140 billion today. The boom clearly reflects the growing wealth of the Islamic community, both in the MENA region and outside. However, due to the generally conservative nature of the industry and the latest downfall in the global financial markets, aviation has only recently started exploring the available alternatives to finance its development and refinance current obligations,” comments Tadas Goberis, the CEO of AviaAM Leasing.

At the moment the total Islamic finance market is estimated at approx. USD2 trillion. Ernst & Young expects that the Islamic banking assets will continue increasing by approx. 19.7% per year over the next several years. However, when it comes to making the funds work, Islamic investors face specific restrictions and risks.

COMPLYING WITH SHARIA

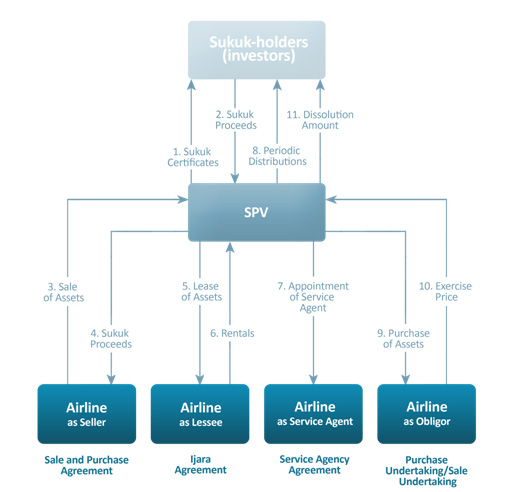

Islam clearly condemns making money from money, e.g. receiving interest from loans thus forbidding interest-based investments. However, it is allowed to receive payments for  renting a property or an asset to a tenant. With this in mind, the Islamic world has developed its own investment category which is generally being referred to as Sukuk (a plural version of Arabic “Saak” – a legal instrument or check). In its modern shape, the Sharia-compliant deals are based on Sukuk certificates (bonds) backed by the asset they are issued for. Through Special Purpose Vehicle companies (SPV) the certificate holders (lessors) receive the ownership rights on the asset and can lease it back to the certificate issuer (lessee). In return, the issuer utilizes the asset and provides the investor with payments in the form of rent. However, according to the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), the amount of the payment may correlate as investors are expected to share the risks with the Sukuk issuer and thus are dependent on the “lessee’s” profits and losses arising out of the Sukuk assets. Once the certificate matures, the issuer may buy the asset based on its market price (though is not obliged, according to Sharia).

renting a property or an asset to a tenant. With this in mind, the Islamic world has developed its own investment category which is generally being referred to as Sukuk (a plural version of Arabic “Saak” – a legal instrument or check). In its modern shape, the Sharia-compliant deals are based on Sukuk certificates (bonds) backed by the asset they are issued for. Through Special Purpose Vehicle companies (SPV) the certificate holders (lessors) receive the ownership rights on the asset and can lease it back to the certificate issuer (lessee). In return, the issuer utilizes the asset and provides the investor with payments in the form of rent. However, according to the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), the amount of the payment may correlate as investors are expected to share the risks with the Sukuk issuer and thus are dependent on the “lessee’s” profits and losses arising out of the Sukuk assets. Once the certificate matures, the issuer may buy the asset based on its market price (though is not obliged, according to Sharia).

“At the same time there are some extra risks. For example, the law forbids selling an asset at the end of the “leasing period” for a pre-agreed fixed price as it requires the asset to be sold for a fair price based on its market value at a given time. Since the residual value may be both lower and higher than the one expected at the beginning of the “leasing” period, the investor may end up with either returns or losses which are hard to predict. However, in the reality many Sukuk deals are structured on more firm grounds which ensure that investors are not left with nothing,” comments Tadas Goberis.

IJARA SUKUK

In a way Sukuk certificates may resemble an Enhanced Equipment Trust Certificate (EETC). At some point it also reflects the model of financial or operating leasing. The final contract depends on the specifics of a particular deal – whether it is an asset, debt, business or other form of investment.

As concerns the aviation industry, Ijara Sukuk (i.e. “rent”) is considered to be one of the most optimal lease forms for many airlines, as it closely corresponds to the conventional leasing transactions.

Table 1. Basic Ijara Sukuk structure

A LOCAL TOUCH IN THE GLOBAL MARKET

Aviation Sukuk may be a great opportunity for Islamic investors to diversify their portfolios. Moreover, it provides them with the chance to invest larger capital while securing it with “hard” liquid assets which maintain quite predictable residual values, particularly when it comes to newly built aircraft.

At the same time, while Islamic investors might be looking for more capital-intense investments and airlines – for financiers to support their “short on cash” expansions, Sukuk may be an emerging, still fully unexplored financing source for leasing companies and other aircraft owners.

“Will Sukuk make a major impact on the aviation finance industry? Maybe not, but it will certainly broaden the market’s access to large capital whilst offering new transaction models and structures,” comments Tadas Goberis, the CEO of AviaAM Leasing. “In return, the global aviation industry can also make a contribution to the development of the Islamic financing. After all, the most common term of Sukuk’s maturity is up to three years whilst in aviation the average finance period is 7-10 years. What it means is that a successful aircraft-related practice may extend the average Sukuk investment as well as diversify a Sukuk portfolio. In either case, one should bear in mind, that today’s alternative may be tomorrow’s mainstream. Whoever catches the wave – wins.”